- A controversial decision by brokerage firms to limit buying in certain high-flying stocks led to sizable intraday declines in so-called Reddit darlings on Thursday.

- Robinhood and Interactive Brokers took action to limit buying after an epic short-squeeze in GameStop sparked by Reddit traders spilled over into a handful of other stocks.

- Detailed below are the seven Reddit stocks that cratered on Thursday.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The epic short-squeeze in shares of GameStop – sparked by traders that frequent Reddit’s WallStreetBets – led to an investor mania that spilled over into other heavily shorted stocks this week.

AMC Entertainment, BlackBerry, and Bed Bath & Beyond are just a few of the stocks that have more than doubled in recent trading sessions as retail investors attempt to squeeze hedge funds out of their short positions.

But on Thursday, several brokerage firms announced that they would restrict its customers from buying shares of the high-flying stocks, and would only allow clients who currently owned the stock to sell, citing the recent volatility.

Robinhood, Interactive Brokers, and WeBull were among the brokers to make the announcement. Margin requirements were also increased at a number of other brokerage firms.

“We continuously monitor the markets and make changes where necessary,” Robinhood said in a press release.

Following the announcement, the Reddit darling stocks that were in the midst of a short-squeeze cratered, with some falling more than 60% in intraday trades.

Amid Thursday's decline, Twitter's @WSBChairman tweeted to his more than half a million followers, "HOLD THE LINE!!! WE WILL NOT BEND THE KNEE."

Detailed below are the seven Reddit darling stocks that are cratering in Thursday's trading session.

1. GameStop

Ticker: GME

Thursday's Decline: 68%

2. AMC Entertainment

Ticker: AMC

Thursday's Decline: 67%

3. BlackBerry

Ticker: BB

Thursday's Decline: 47%

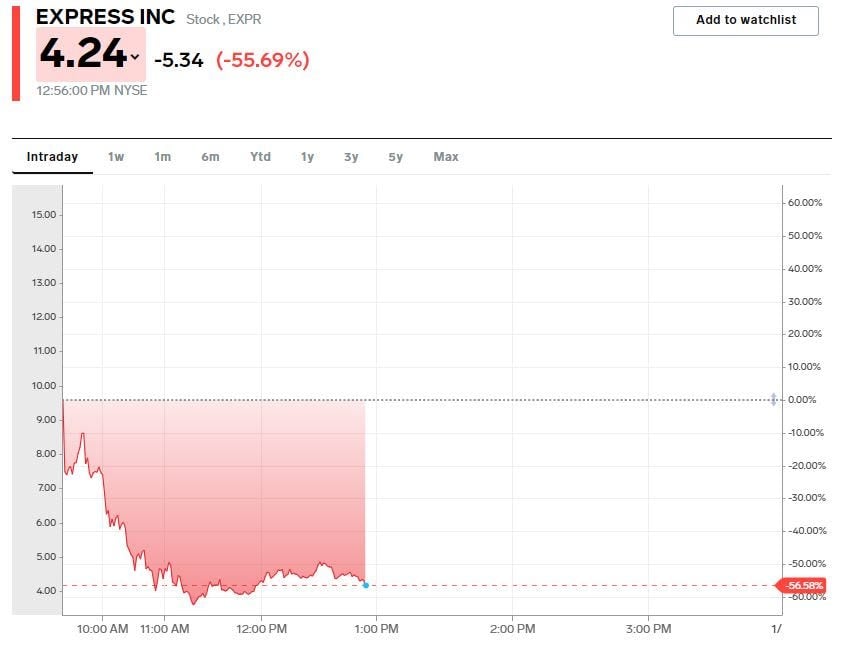

4. Express Inc.

Ticker: EXPR

Thursday's Decline: 64%

5. Bed Bath & Beyond

Ticker: BBBY

Thursday's Decline: 43%

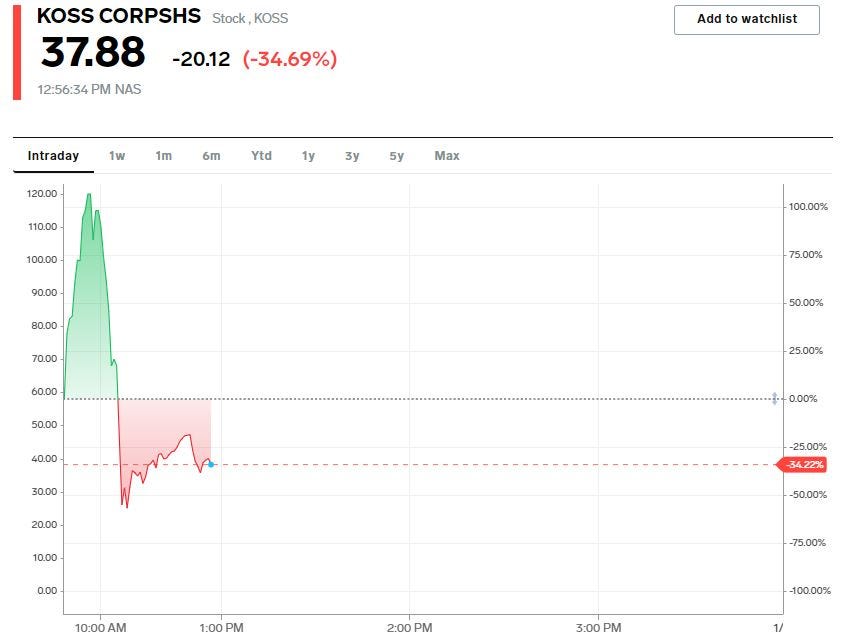

6. Koss Inc.

Ticker: KOSS

Thursday Decline: 57%

7. Nokia

Ticker: NOK

Thursday Decline: 30%

*Thursday's intra-day decline figures are based off of prices as of 1:04 p.m ET.